- Policy

- Corporate Governance Structure

- Board of Directors and Audit & Supervisory Board

- Independent Outside Directors and Independent Outside Audit & Supervisory Board Members

- Nomination Committee and Compensation Committee

- Policy on Determination of Director Compensation and Total Compensation

- Policy and Process for the Nomination of Directors and Audit & Supervisory Board Members

- Effectiveness Evaluation of the Board of Directors

- Policy for Strategic Shareholding

- Policy and Reasons for Selecting an Audit Firm

Policy

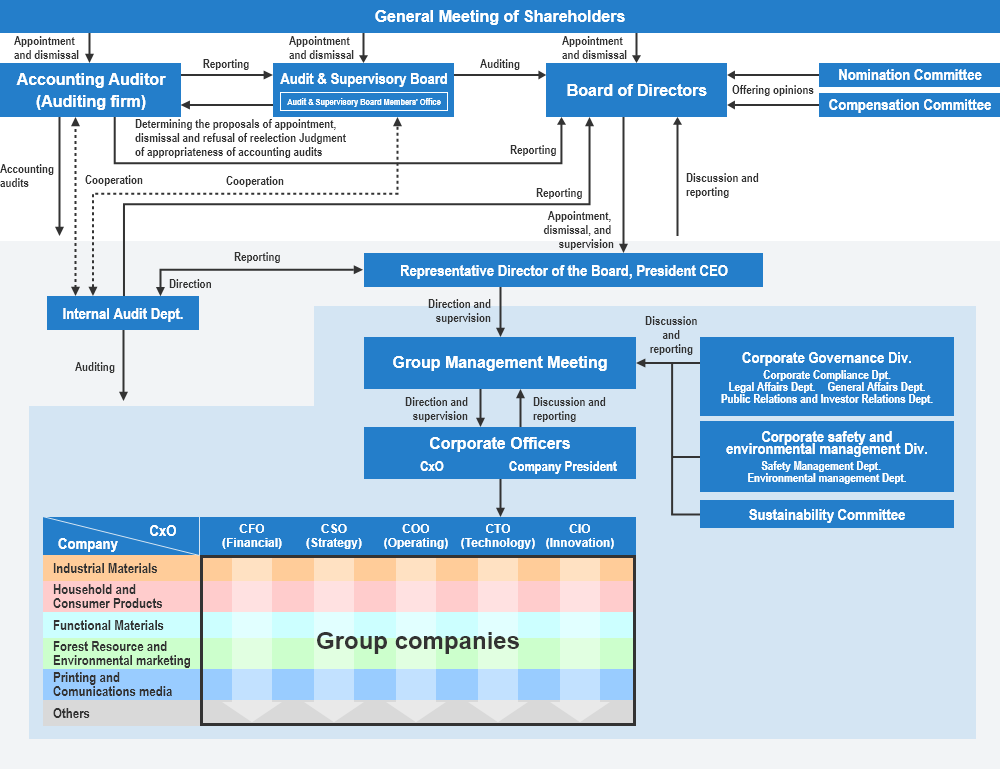

Corporate Governance Structure

The Group has adopted a COMPANY system under which Oji Holdings formulates Group management strategies and supervises Group governance, while each COMPANY comprised of closely associated businesses forms the center of the Group’s business operations. This structure accelerates the decision making of each business unit and clarifies management responsibilities. Additionally, from April 1, 2025, CxO system is introduced to strengthen governance across functions beyond business units and regions, forming a matrix organization combined with the Company system.

As a company with an audit and supervisory board, the Company strives to strengthen the governance of the entire Group by implementing audits of the Directors’ execution of their duties conducted by the Audit & Supervisory Board and its members. The Board of Directors consists of 9 Directors (including four Independent Outside Directors) and the Audit & Supervisory Board consists of five Audit & Supervisory Board Members (including three Independent Outside Audit & Supervisory Board Members). The Representative Director and Chairman of the Board chairs the Board of Directors.

Main role of each CxO

-CEO:

Overall supervision

-CFO (Financial):

Financial and capital strategies, corporate governance

-CSO (Strategy):

Group-wide management strategies, marketing and sales strategy

-COO (Operating):

Execution of production and sales strategies, understanding of customer needs

-CTO (Technology):

Oversee technological aspects of the entire Group, including advanced technologies

-CIO (Innovation):

Concentrated execution of innovation such as new business and product development

Board of Directors and Audit & Supervisory Board

Purpose of the Board of Directors

The Board of Directors, in view of its fiduciary responsibility and accountability toward shareholders, fulfills the following roles to enable the Company to achieve sustainable growth and enhance its corporate value over the medium to long term as well as to improve its profitability, capital efficiency, etc.

- Make important decisions concerning business execution within the scope specified in the Board of Directors Rules, such as determining the corporate principles and strategies that set out the overall direction for the Group and making investments based on these principles and strategies.

- With regard to matters that do not require a Board of Directors’ resolution, assist with rapid decision-making by determining in Group rules matters requiring deliberation by the Management Meeting and the authority of Executive Directors to execute business.

- Conduct highly effective supervision of Corporate Officers and Executive Directors from an independent and objective standpoint.

- Supervise the construction of internal control systems, the establishment of risk management systems, and the operation of these systems.

Composition of the Board of Directors

The maximum number of Directors is 15 in principle, and at least 2 of them are Independent Outside Directors. In addition, 19 Corporate Officers, 4 of whom serve concurrently as Directors, are selected (as of late June, 2025) to speed up decision-making, strengthen the business execution system, and clarify executive responsibilities.

Corporate Officers

The Board of Directors, in order to fulfill a role necessary for achieving sustainable growth of and improvement of corporate value of the Group over the medium to long term, has been organized while giving due consideration to the balance of diverse knowledge and expertise concerning the business of the Group.

There are currently 9 Directors, 4 of whom are Independent Outside Directors (including 3 female Directors).

The Nomination Committee, which is an advisory body to the Board of Directors, deliberates upon the selection of candidates for Directors and the appointment of Group Corporate Officers before submitting a report to the Board of Directors. Regarding candidates for Audit & Supervisory Board Members, a report is submitted to the Board of Directors after consulting the Nomination Committee and obtaining the consent of the Audit & Supervisory Board.

The Nomination Committee consists of all outside directors, and the Board of Directors receives the report from the Nomination Committee deliberates and makes decisions.

Purpose of the Audit & Supervisory Board

The Audit & Supervisory Board and its Members conduct operational audits and accounting audits from an independent and objective standpoint, fulfilling their fiduciary duty to shareholders.

The Audit & Supervisory Board and its Members strive to actively exercise their authority by actively combining the advanced information gathering capabilities of the Standing Audit & Supervisory Board Members and the strong independence of the Independent Outside Audit & Supervisory Board Members while maintaining the cooperation with the Independent Outside Audit & Supervisory Members.

Audit & Supervisory Board Members regularly meet with the Accounting Auditor to receive explanations regarding audit plans and the status of the implementation of audits, as well as financial statement audit results, and to exchange opinions.

The Audit & Supervisory Board Members and the Companyʼs Internal Audit Department meet once every month to exchange information regarding audit plans and results and ensure cooperation between them.

Composition of the Audit & Supervisory Board

The Audit & Supervisory Board is composed of five Audit & Supervisory Board Members (including three Independent Outside Audit & Supervisory Board Members). The Audit & Supervisory Board Members ensure transparency and monitor and verify management. Audit & Supervisory Board Members attend meetings of the Board of Directors and other important meetings in line with the audit plan established by the Audit & Supervisory Board for auditing the Directors’ execution of their duties.

Teruo Yamazaki, an Audit & Supervisory Board Member, has experience in the finance and accounting division of the Company and its Group companies. His knowledge in the area of finance and accounting is considerable.

In addition, Keiko Fukuchi, an Outside Audit & Supervisory Board Member, as a certified tax accountant, has a wealth of experience, a high degree of expertise, and a wide range of insights in taxation and corporate accounting. She possesses considerable knowledge of finance and accounting.

Independent Outside Directors and Independent Outside Audit & Supervisory Board Members

Status Of Independent Outside Officers' Activities and Reasons For Their Appointment

Oji Holdings has appointed four Outside Directors and three Outside Audit & Supervisory Board Members, each of whom is designated as an Independent Officer. The Independent Officers attend the meetings of the Board of Directors and briefings (held basically twice a month) conducted by the officer responsible for the Corporate Governance Division regarding matters submitted to the Management Meeting and matters planned to be submitted to the Board of Directors. The Nomination Committee and the Compensation Committee comprise Independent Outside Directors.

People with highly specialized and wide-ranging knowledge who are able to express opinions that are independent from management and from the perspectives of various stakeholders are selected to be Independent Outside Director candidates, and people with excellent character and insight, a high degree of specialization, and extensive experience are selected to be Independent Outside Audit & Supervisory Board Member candidates.

In FY2024, the attendance of the seven Independent Outside Directors and Independent Outside Audit & Supervisory Board Members at meetings of the Board of Directors (15 meetings held) averaged 99.0%, and the attendance of Independent Outside Audit & Supervisory Board Members at the Audit & Supervisory Board meetings (13 meetings held) was 100%.

Main Actitivies Of Independent Outside Officers In FY2024

| Category | Name | Attendance at Board of Directors meetings | Summary of statements made and duties performed with respect to expected role |

|---|---|---|---|

| Independent Outside Director | Michihiro Nara | Attended 15 of 15 meetings (93.3%) | Fulfilled the role expected of him by making comments concerning the Companyʼs management from an independent standpoint, from a legal perspective as an attorney-at-law, and based on his extensive experience, high level of expertise, and wide-ranging insight |

| Independent Outside Director | Seiko Nagai | Attended 15 of 15 meetings (100%) | Fulfilled the role expected of her by making comments concerning the Companyʼs management from an independent standpoint, from a multifaceted perspective, including professional viewpoints developed through customer service and university teaching, and based on her extensive experience, high level of expertise, and wide range of insight |

| Independent Outside Director | Hiromichi Ogawa | Attended 15 of 15 meetings (100%) | Fulfilled the role expected of her by making comments concerning the Companyʼs management from an independent standpoint, from a multifaceted perspective, including professional viewpoints developed through management of retail business and food manufacturing companies, and based on his extensive experience, high level of expertise, and wide range of insight |

| Independent Outside Director | Sachiko Fukuda | Attended 11 of 11 meetings (100%) | Fulfilled the role expected of her by making comments concerning the Company`s management from an independent standpoint, from a multifaceted perspective including a legal perspective as an attorney-at-law,and financial accounting perspective as an Certified Public Accountant and sustainability perspective, and based on her extensive experience, high level of expertise, and wide range of insight |

- * The attendance record of Sachiko Fukuda pertains only to the board meetings held after her appointment on June 27, 2024.

Main Activities of Independent Outside Audit & Supervisory Board Members in FY2024

| Category | Name | Attendance at Board of Directors meetings | Attendance at Board of Audit & Supervisory Board meetings | Statement at Meetings |

|---|---|---|---|---|

| Independent Outside Audit & Supervisory Board Member | Hidero Chimori | Attended 15 of 15 meetings (100%) | Attended 13 of 13 meetings (100%) | Provided expert opinions based on his extensive experience, high- level expertise and wide-ranging knowledge, in particular, in the corporate legal affairs and corporate governance field, as an attorney-at-law |

| Independent Outside Audit & Supervisory Board Member | Noriko Sekiguchi | Attended 15 of 15 meetings (100%) | Attended 13 of 13 meetings (100%) | Provided expert opinions based on her abundant practical experience at companies in addition to her extensive experience, high- level expertise and wide-ranging knowledge on financial accounting as a certified public accountant |

| Independent Outside Audit & Supervisory Board Member | Takashi Nonoue | Attended 15 of 15 meetings (100%) | Attended 13 of 13 meetings (100%) | Provided expert opinions based on his extensive experience, high- level expertise and wide-ranging knowledge as a public prosecutor and attorney at law. |

Nomination Committee and Compensation Committee

Purpose of The Nomination Committee

The Nomination Committee Deliberates on the following issues and matters and submits reports to the board of directors to strengthen the indepedence, objectivity and accountability of the deirectors in implementing their funcions regarding the nomination of officers and corporate officers by appropriately involving independent outside directors in the process and obtaining advice them.

- Policies for The Nomination of Candidate Directors and Audit & Supervisory Board Members

- Policies for The Appointment of Corporate Officers

- Nomination of Directors and Audit & Supervisory Board Members, Appointment of Corporate Officers

- Dismissal of Directors, Autid & Supervisory Board Members or Corporate Officers in cases where they do not fulfill the criteria in nomination and appointment policies

- Succession Planning for The Board of Directors and The President

- Appointment and Dismissal of Advisors

Purpose of Compensation Committee

The Compensation Committee Deliberates on The Following Issues and Matters and Submits Reports to The Board of Directors to Strengthen The Independence, Objectivity and Accountability of The Directors in Inplementing Their Funcions Regarding The Compensation of Directors and Corporate Officers by Appropriately Involving Independent Outoside Directors in The Process and Obtaining Advice from them.

- Structure and Level of Compensation for Directors and Corporate Officers

- Performance-linked compensation for Directors and Executive Officers, and performance evaluation of Executive Officers

- Analysis and Evaluation of The Effectiveness of The Board of Directors

- Structure and Level of Compensation for Advisors

Structures of the Nomination Committee and the Compensation Committee and their meetings held in FY2024

| Position | Name | Nomination Committee |

Attendance | Compensation Committee |

Attendance |

|---|---|---|---|---|---|

| Director, Chairman of the Board | Masatoshi Kaku | 2/2 | 4/4 | ||

| Director of the Board, President | Hiroyuki Isono | Committee Chair | 2/2 | Committee Chair | 4/4 |

| Independent Outside Director | Michihiro Nara | 2/2 | 4/4 | ||

| Independent Outside Director | Seiko Nagai | 2/2 | 4/4 | ||

| Independent Outside Director | Hiromichi Ogawa | 2/2 | 4/4 | ||

| Independent Outside Director | Sachiko Fukuda | 2/2 | 4/4 |

Policy on Determination of Director Compensation and Total Compensation

Policy on Determination of Director Compensation

Oji Holdings has designed its compensation programs to emphasize the roles of the director compensation program in encouraging the Board of Directors to work to achieve the sustainable growth of the company, increase its corporate value over the medium- to long-term, and enhance its profitability and capital efficiency. The compensation program and the policies for determining compensation are laid out in the Fundamental Policies on Corporate Governance. Director compensation comprises base compensation, which is fixed compensation, bonuses that reflect short-term performance, and stock-based compensation that reflects the medium- to long-term increase of corporate value. The Board of Directors uses the recommendations submitted by the Compensation Committee when determining compensation. Evaluations for determining bonuses include the consideration of the overall status of the achievement of evaluation items related to ESG issues.

Please refer to the Annual Securities Report for more information about performance-linked compensation, which includes bonuses and stock-based compensation.

Performance-Linked and Non-Performance-Linked Compensation Ratios (From 27th June 2025)*

| Position | Fixed compensation |

Performance-linked compensation | Total | ||

|---|---|---|---|---|---|

| Bonuses | Stock-based compensation | Total | |||

| Representative Director, Chairman of the Board |

45% |

27.5% | 27.5% | 55% | 100% |

| Representative Director of the Board, President |

45% |

27.5% | 27.5% | 55% | 100% |

| Representative Director of the Board, Executive Vice President |

45% |

27.5% | 27.5% | 55% | 100% |

| Director of the Board, SeniorExecutive Officer |

45% |

27.5% | 27.5% | 55% | 100% |

| Director of the Board, Executive Officer |

45% |

27.5% | 27.5% | 55% | 100% |

| Independent Outside Director | 100% | - | - | - | 100% |

- * The payment ratios will fluctuate due to changes in performance-linked compensation such as bonuses and stock-based compensation.

Total Amount of Compensation for Each Officer Category, Total Amount of Compensation, etc., by Type and Number of Eligible Officers (FY2024)

| Officer category | Total amount of compensation (million yen) | Total amount of compensation, etc. by type (million yen) | Number of eligible officers (persons) | ||

|---|---|---|---|---|---|

| Fixed compensation | Performance-linked compensation | ||||

| Bonuses | Stock-based compensation | ||||

| Directors (excluding Independent Outside Directors) | 428 | 215 | 98 | 115 | 8 |

| Audit & Supervisory Board Members (excluding Independent Outside Audit & Supervisory Board Members) |

56 | 56 | - | - | 2 |

| Independent Outside Directors and Independent Outside Audit & Supervisory Board Members |

99 | 99 | - | - | 8 |

Policy and Process for the Nomination of Directors and Audit & Supervisory Board Members

Policy

The Oji Holdings Fundamental Policies on Corporate Governance stipulate in the director nomination policy that the Board of Directors shall comprise directors with extensive and balanced knowledge and expertise concerning the businesses operated by the group. The Fundamental Policies also stipulate that the candidates nominated to be directors possess excellent character and insight and be people capable of contributing to the sustainable growth of the group and the increase of its medium- to long-term corporate value, and that Audit & Supervisory Board member candidates be people of excellent character and insight with a high degree of specialization and extensive experience that are capable of fulfilling the duties of the Audit & Supervisory Board members.

Process

When nominating director candidates, the Nomination Committee, an advisory body to the Board of Directors, deliberates issues and submits recommendations to the Board of Directors. Regarding the nomination of candidate Audit & Supervisory Board members, the Nomination Committee deliberates on the issues and then submits its recommendations to the Board of Directors after approval by the Audit & Supervisory Board. The Board of Directors receives reports from the committee, deliberates the issues, and makes decisions regarding these matters.

Director Skill Map

In order to realize Oji Group's management strategies, it is composed of the skills that are particularly necessary for the Board of Directors to make appropriate management decisions and demonstrate high effectiveness in the supervision.

The definition of each skill are as follows:

| Skill | Definition |

|---|---|

| Corporate management |

Basic management skills required to realize corporate sustainability and management strategy |

| Finance & accounting and capital strategy | Skills to grasp business conditions financially and raise questions, and to realize capital efficiency improvement |

| Innovation and manufacturing | Skills to create innovative ideas and technologies for non-continuous growth and give a concrete shape to them |

| Marketing, branding and market structure | Skills to anticipate needs and differentiate products and services and to build new business models |

| Business portfolio conversion and production system building | Skills to establish and restructure business and to bring about stable and efficient production under an optimum system |

| Global | Skills to raise questions and make decisions from a global perspective |

| Human capital and DX | Skills to reform business processes through development and utilization of diverse human resources and promotion of digitization |

| Sustainability and ESG | Skills related to environment, society, and governance; they are foundations of corporate management and also indispensable for sustainability |

| Legal affairs, compliance and risk management | Skills to supervise corporate activities, predict risks, and make proposals against risks from the perspective of legal affairs |

| Name | Positions in the Company | Nomination and Compensation Committee |

Highly Expected Roles | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate management |

Finance & accounting and capital strategy | Innovation and manufacturing | Marketing, branding and market structure | Business portfolio conversion and production system building | Global | Human capital and DX | Sustainability and ESG | Legal affairs, compliance and risk management | |||

| Masatoshi Kaku | Representative Director and Chairman of the Board |

● | ● | ● | ● | ● | |||||

| Hiroyuki Isono | Representative Director of the Board, President |

● | ● | ● | ● | ● | ● | ● | |||

| Kazuhiko Kamada | Representative Director of the Board, Executive Vice President |

● | ● | ● | ● | ● | ● | ● | |||

| Akio Hasebe | Director of the Board, Senior Executive Officer |

● | ● | ● | ● | ||||||

| Satoshi Takuma | Director of the Board, Executive Officer | ● | ● | ● | ● | ||||||

| Seiko Nagai | Outside Director (Independent Director) | 〇 | ● | ● | ● | ||||||

| Hiromichi Ogawa | Outside Director (Independent Director) | 〇 | ● | ● | ● | ||||||

| Sachiko Fukuda | Outside Director (Independent Director) | 〇 | ● | ● | ● | ||||||

| Atsuko Muraki | Outside Director (Independent Director) | 〇 | ● | ● | ● | ||||||

- * People marked with a 〇 are members of the Nomination and Compensation Committee.

- * ● marks indicate the roles expected of each Director and does not represent all of the abilities possessed by each director.

Effectiveness Evaluation of the Board of Directors

The Company stipulates in its “Fundamental Policies on Corporate Governance” that the Board of Directors conducts analysis and evaluation of its effectiveness every year and takes required measures to ensure the effectiveness as a whole as well as discloses an overview of the findings.

In order to evaluate the effectiveness of the Board of Directors in FY2024, we conducted a survey on the roles, organization and management of the Board of Directors for all of the Directors and Audit & Supervisory Board Members from April to May 2025. The evaluation results were analyzed by the Compensation Committee in which Independent Outside Directors participated, and deliberated by the Board of Directors based on the analysis results.

As a result, we confirmed that the Company's Board of Directors, including its accompanying meeting bodies, has been effective. In response to the question regarding the role of the board of directors, whether it was able to formulate group management strategies and provide direction, many respondents answered that the Board of Directors actively engaged in the formulation of Long-term Vision and Medium-term Management Plan, as well as the deliberation and discussion of individual matters, thereby ensuring that the Board of Directors operated with a focus on effective supervision of management, and was able to clearly demonstrate its direction. To the question of whether the company has established an internal control and risk management system and supervised its operation, some respondents said that although internal control and risk management system are appropriately established, the violation of rules and the occurrence of labor accidents have not been eradicated, and therefore the company needs to continue strengthening its system. To the question of whether the company has promoted constructive dialogue with stakeholders, some said that although investor relations activities were highly regarded for promoting constructive dialogue, these activities need to be further enhanced.

On April 1, 2025, we revised our corporate officer system to clarify Directors’ supervisory functions and roles as corporate officers and, as a result, changed the title of Group Corporate Officer to Corporate Officer.

We also adopted the CxO system in order to achieve further maximization and total optimization of Group synergy.

Under the above framework, we judge that the effectiveness of management oversight has been strengthened. We will continue to consider and implement necessary measures to enhance the functionality of the Board of Directors.

Policy for Strategic Shareholding

The Group strategically holds shares that are expected to contribute to the sustainable growth of the Group and the improvement of corporate value over the medium- to long-term as part of its management strategy for the purpose of business alliances and strengthening and maintenance of long-term and stable relationships with business partners. The Group is reducing its strategic shareholdings by reviewing the rationale for holding each individual share at the annual Board of Directors meeting, and steadily reducing them through stricter management. In addition, the Group is engaging in careful dialogue with the issuers of the shares to be reduced, to ensure they understand our policy.

In FY2024, we reduced the number of strategic shareholdings by 29 billion yen. Additionally, in the Medium-Term Management Plan 2027 announced on May 30, 2025, we plan to reduce strategic shareholdings by 45 billion yen and the amount of retirement benefits trust contribution shares exceeding the accumulated retirement benefit trust of our group companies by 21 billion yen over the three-year period from FY2025 to FY2027.

Please refer to the Company’s Securities Reports for details on individual strategic shareholdings.

Policy and Reasons for Selecting an Audit Firm

We select our accounting auditor, taking into consideration the following factors: that the accounting auditor has established a system for maintaining and improving the quality of audits, that it is independent and possesses the necessary expertise, that it is of a reasonable scale and that it has an overseas network that enables it to provide efficient audit services that respond to the nature of the Company's business.

The Audit & Supervisory Board decides the content of proposals regarding the dismissal or non-reappointment of the accounting auditor to be submitted to the General Meeting of Shareholders in the event that it is deemed difficult for the accounting auditor to perform its duties properly.

The Audit & Supervisory Board shall dismiss the accounting auditor with the unanimous consent of the Corporate Auditors if any of the items of Article 340, Paragraph 1 of the Companies Act are deemed to be applicable regarding the accounting auditor.

The Audit & Supervisory Board has agreed to reappoint Deloitte Touche Tohmatsu LLC as the accounting auditor for fiscal year 2024. It is believed that Deloitte Touche Tohmatsu LLC has the necessary framework for ensuring that adequate accounting audits are conducted, taking into consideration the following factors regarding the evaluation of audit performance:

- Quality control of the audit firm

- Audit team

- Audit fees, etc.

- Communication with the Audit & Supervisory Board

- Relationship with management

- Group audits

- fraud risks

Engagement partners are rotated in accordance with the Certified Public Accountants Act and other applicable regulations as follows: The engagement partner cannot be involved in the Company's auditing services for more than seven consecutive accounting periods. The lead engagement partner cannot be involved in the Company's auditing services for more than five consecutive accounting periods.